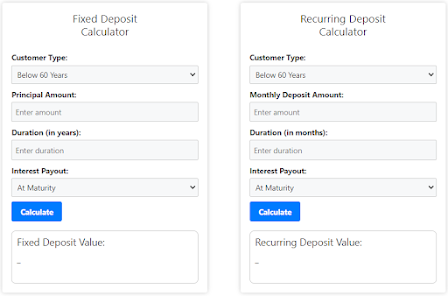

RD Calculator - Recurring Deposit Calculator Online India

An investment instrument similar to fixed deposits is recurring deposits (RDs). However, RDs require you to deposit a fixed amount each month, as opposed to a lump sum amount in FDs. RDs create a habit of regular investment among earning individuals. They also foster discipline when it comes to saving. The majority of banks and financial institutions offer recurring deposits. The calculation of RD returns can be quite complicated for an average investor. That's why an RD calculator can be extremely useful. How can an RD calculator help you? As the name implies, recurring deposits are continuing investments. They can be difficult to track for investors because interest is compounded quarterly and there are several variables involved. The RD deposit calculator eliminates the hassle of manually calculating returns and enables investors to know exactly how much their deposits will grow. It is only the TDS deduction that the investor has to take into consideration manually. Acco...