RD Calculator - Recurring Deposit Calculator Online India

An investment instrument similar to fixed deposits is recurring deposits (RDs). However, RDs require you to deposit a fixed amount each month, as opposed to a lump sum amount in FDs. RDs create a habit of regular investment among earning individuals. They also foster discipline when it comes to saving. The majority of banks and financial institutions offer recurring deposits.

The calculation of RD returns can be quite complicated for an average investor. That's why an RD calculator can be extremely useful.

How can an RD calculator help you?

As the name implies, recurring deposits are continuing investments. They can be difficult to track for investors because interest is compounded quarterly and there are several variables involved.

The RD deposit calculator eliminates the hassle of manually calculating returns and enables investors to know exactly how much their deposits will grow.

It is only the TDS deduction that the investor has to take into consideration manually. According to new RBI norms, RDs are also liable for TDS deduction; however, it has not been implemented uniformly across financial institutions, which is why RD calculators do not take it into account.

Apart from that small caveat, an RD amount calculator offers an investor with the following advantages:

Through the calculator, investors can plan their future finances with greater clarity by knowing exactly how much they will accumulate from their investments.

In addition to being convenient to use, it saves investors a lot of time, which they could otherwise use productively.

For prudent financial planning, accurate estimates are pivotal. The accuracy of these calculators cannot be questioned.

Formula to determine RD maturity

The RD maturity amount is calculated by assigning three variables to a standard formula. An RD account calculator uses this formula to determine the exact amount.

The formula for RD maturity is as follows:

A = P*(1+R/N)^(Nt)

The variables in this equation represent-

It is the standard formula for calculating the maturity amount for RDs regardless of the amount invested or tenure.

For example, an individual starts an RD account for an investment of Rs. 5000 per month for a tenure of 1 year, i.e. 4 quarters. The interest accrued on this account is 8%. The final maturity amount on this particular deposit is calculated with the following formula-

A = P*(1+R/N)^(Nt)

= 5000*(1+.0825/4)^(4*12/12) = 5425.44

= 5000*(1+.0825/4)^(4*11/12) = 5388.64

…

= 5000*(1+.0825/4)^(4*1/12) = 5034.14

By taking the sum of series, total maturity value, i.e. A = Rs 62,730.85

The recurring deposit calculator, however, will provide you with the exact number in a matter of seconds.

The maturity value for the depositor on the investment in RD is INR Rs 62,730.85

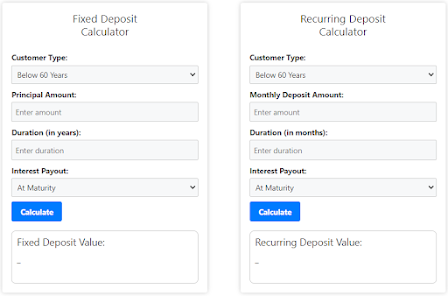

How to use the Groww RD calculator online?

Groww's RD calculator is easy to use and requires no subject expertise. Below you will find a step-by-step guide on how to use it.

Step 1: Input the monthly amount you would be putting in the recurring deposit

Step 2: Enter the number of years and the expected rate of return.

The total value of the investment after the tenure will be expressed within seconds.

Advantages of using RD maturity calculator

Depositors can take advantage of these benefits by using Groww's online RD calculator.

It performs the calculations in seconds, and the entire process from visiting their website to using it takes no longer than 1-2 minutes.

When you input every variable correctly, there will be no errors or ambiguities.

Depositors can use this as many times as they like. You can enter one or more variables in as many variations as you want.

Investing in recurring deposits is considered a stable financial investment with high potential returns. You can use online calculators to compare the performance of several other investment schemes for the same amount.

Invest in direct mutual funds for free with Groww by opening an account.

FAQs

Is TDS applicable on RD?

Effective from June 1, the Finance Bill, 2015, has made TDS mandatory for all recurring deposits. Note that it applies only to interest accrued on the RD.

What is the minimum amount to start an RD account?

RD accounts can be opened with as little as Rs. 500, and you can deposit the same amount every month throughout the tenure of the account. Similarly, there is no maximum deposit.

Can I break my RD prematurely?

Your RD account may be closed before maturity. Interest will be paid until the date of closing, and your financial institution may also charge a penalty.

What is RD’s range of tenure?

You can choose tenure in multiples of 3 months after the first 6 months, i.e., 9 months, 12 months, 15 months, etc., up to 10 years.

Comments

Post a Comment